I have yet to see a day using a prime account where the spreads are as low as 0.1. You charge the average of high spreads (even for majors and high liquid markets) + a commission. Why is the spread of EURUSD for example 1.2 during the highest and most liquid moment of the day? And on top of that you charge extra commission for a prime and institutional account. I can open an account with other competitors that actually provide lower spreads without commissions.And the customer service went from great to horrible. Tradingview, always errors after errors while trading having a huge affect on my trading.

Payment Methods

BlackBull Markets is one of these trusted and legitimate brokers, so you can have confidence in their security and reliability. What better way to learn and improve your trading skill than actually investing with zero risk. Once you fill out the form and submit the required document, the team will review your application. So whether you’re a seasoned trader looking to up your game or a newcomer just starting out, BlackBull Markets has you covered. Whether you are a seasoned trader or just starting out, this is always very useful.

Spread Charged in our Trades

- I highly recommend black bull..it’s really good trading platform so far.

- The Quickstart dropdown tab on the top of the menu can answer some of your questions regarding the company and its various services.

- Although the account opening process follows the standard norm in the retail forex industry, Benzinga finds BlackBull’s process highly simplified.

- All in all, this broker makes for a great choice for both novice and experienced traders alike.

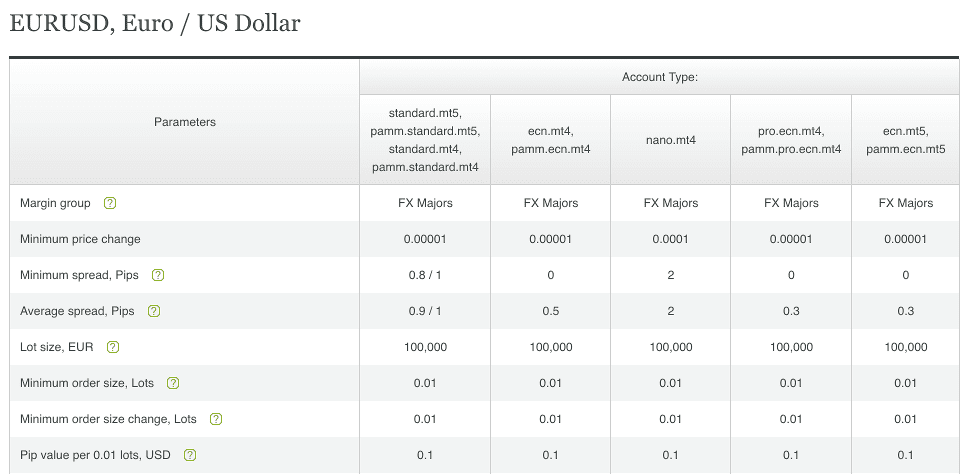

BlackBull Markets spreads are definitely very competitive but in order to gain access to the lowest ones, a user must be willing to start with an ECN prime account with a minimum deposit of $2,000. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. BlackBull Markets do charge a small fee on deposits, on all methods besides PayPal. Bank Transfers have a 20 base account currency fee, and Skill/Neteller both have a 5 base account currency fee. The large majority of Forex brokers do charge a small withdrawal fee and the fees charged by BlackBull are very competitive.

Deposits/Withdrawals

The platform is easy to use, with an intuitive interface that makes navigating between different sections easy. Blackbull Markets also offers competitive spreads, low commissions, and fast execution speeds. All these features make the platform attractive to traders of all levels. BlackBull Markets offers the MT4 trading platform, sometimes known as MetaTrader 4. MT4 is without a doubt the most common retail forex trading platform, being used by millions of traders and hundreds of brokers around the world. Although MT4 is certainly not the most advanced platform on the market, is it perfect for basic technical analysis and order execution, making it the peoples choice.

Customer Support Channels

BlackBull Markets offers a range of fee-free funding methods while requiring no minimum deposit to start trading. The minimum deposit of Blackbull Markets is $0 on the base account, which goes higher for the prime and institutional accounts. For most Forex currency pairs, the minimum spread is as low as 0, when you choose the ECN Institutional Account.

The customer support team at Blackbull Markets is dedicated to providing traders with fast and reliable service. They are available 24/7 via phone, email, or live chat to assist with any issues that may arise. The customer service reps are knowledgeable and friendly, making it easy to get answers quickly when needed.

Free VPS hosting is available to clients with $2000 or more in their accounts and at least 20 lots of traded volume per month. My tests indicate that the pricing mechanism of BlackBull’s Standard account meets the industry average when it comes to commission-free trading accounts. Meanwhile, its Prime account features marginally lower prices compared to most ECN accounts. Furthermore, BlackBull incorporates advanced platforms (TradingView, cTrader) with professional-grade charting capabilities. These accommodate high-frequency trading and allow traders to conduct sophisticated technical analyses.

BlackBull Markets is a multiple award-winning New Zealand-based forex and contract for difference (CFD) broker with over 26,000 tradable instruments, including equities, cryptocurrencies, indices and commodities. CFD trading lets you profit from rising and falling markets by entering into contracts with a broker to exchange the difference in an asset’s value between the opening and closing of the trade. However, there are several futures contracts available for more experienced traders to hedge against both expected and unexpected changes in volatility.

All in all, this broker makes for a great choice for both novice and experienced traders alike. BlackBull Markets provides a wide range of account types that cater to all levels of traders from entry-level beginners to experienced professionals. All accounts offer competitive spreads https://forexbroker-listing.com/ and commissions, plus powerful tools that allow users to maximize their potential profits from every trade they make. BlackBull’s FIX API facilitates ECN integration and direct market access (DMA) by directly connecting institutional traders to BlackBull Markets’ bridge provider.

If the margin call threshold is reached and no new funds are added to the account, the system will start the partial closing down of open trades. That way, the risk of incurring bigger losses is lessened, while the chance for a reversal is retained. The smart stop-out tool provides highly speculative traders with more sophisticated protection against adverse volatility. BlackBull Markets also provides FIX API and Virtual Private Server (VPS) hosting for low-latency trading, mitigating the risk of negative slippage.

Suppose you’re an active day trader or swing trader aiming to refine your strategies and develop unique trading styles. In that case, TradingView is a must-have tool in your trading arsenal. The platform blends limitless flexibility and customizability with unparalleled functionality and ease of use. Highlights of its analytical features include 400+ built-in indicators, 100,000+ community-built indicators, 20+ timeframes and 15+ chart types.

If you enjoy multi-asset trading on the go and need a robust mobile platform, BlackBull Trade might just be what you need. This is more so because its features mirror MT4/MT5 and cTrader but with added flexibility and convenience. Having been a retail trader since 2013, Plamen has gained an in-depth understanding of the challenges that novice traders face today.

The platform goes the extra mile to ensure the security of its customers, employing cutting-edge encryption technology for peace of mind. SSL encryption safeguards all transactions, and funds are securely held in segregated accounts at top-tier banks. Additionally, the responsive customer support team is at your service 24/7, accessible via email or live chat, ensuring prompt assistance whenever required. Blackbull Markets offers a variety of account types tailored to cater to the unique preferences and risk tolerance levels of different traders. This adaptability empowers users to select the most suitable account type that aligns with their trading style.

If you’re a BlackBull share investor, you’ll find TradingView invaluable not only for its efficient stock screener, alert system and technical analytical tools but also for its other noteworthy features. It is ideal for expert multi-asset traders seeking a more powerful trading technology. It boasts 44 analytical charting tools, 21 timeframes and 38+ preinstalled technical indicators. It also features a depth of market (DoM), detachable charts, an integrated economic calendar and extra pending order types (sell stop limit and buy stop limit). I assess that BlackBull Markets’ research content is mostly geared towards technical analysis, with some fundamental breakdowns.

The broker is also licensed by The Seychelles Financial Services Authority (FSA). Finally, we withdrew our funds to assess whether the withdrawal process was smooth. We traded the popular instrument in each market to identify the actual spreads and placed a total of 12 trades. Although 20 different payment methods are offered, availability varies depending on your location. For instance, New Zealanders aren’t offered cryptocurrency as a payment method, yet the only country able to use POLi. BlackBull Markets achieves rapid order execution through globally distributed servers, including the NY4 Equinix data centre in New York and others in London, Japan, Hong Kong, and Shanghai.

Given its fast execution speeds, averaging around 75 milliseconds, and affordable pricing, BlackBull Markets is particularly well-suited for high-frequency trading. The broker is also an excellent option for technical traders, including those interested in social and automated trading strategies. BlackBull Markets provides two retail account types in addition to blackbull markets review an institutional one. Account creation is fast and easy, and the trader may also opt for a demo or Islamic account. The one thing I could not find, which left me disappointed, was a reference to negative balance protection. It appears that BlackBull Markets does not offer it, making highly leveraged trading an especially high-risk approach with this broker.

This is great because you can stop trading for the time that you want, and you can be sure that no inactivity fee will be charged to you. This means that you can trade using micro lots, equivalent to 1,000 units of the base currency, which is the same as trading with a 0.01 lot size. On the other hand, you can get awarded up to $250 for referring a friend.

BlackBull Markets’ customer service team was quite helpful and gave us direct and prompt answers that were very accurate. Our first interaction with the team was via live chat, where we asked about the order execution and whether they allow hedging, scalping and change of leverage. BlackBull Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as highly customizable TradingView to its clients. Clients can access the two platforms via the desktop and mobile MT4 and MT5 applications.

Leave a Reply

Your email is safe with us.